It is painful to imagine ever being in a situation where we will not have total control over our own affairs but the reality is, disaster can strike us at any time.

Anyone of any age can have an accident, suffer an unexpected heart attack or potentially develop dementia.

Some people think if you lose capacity then a close family member or spouse/civil partner/unmarried partner can automatically take over the reins to access your money on your behalf and even pay for your care. Unfortunately that is simply not the case, unless the proper paperwork is in place.

Lasting Power of Attorney (LPA)

Click here to access our LPA Factsheet

A Lasting Power of Attorney (LPA) is a legal document which allows you to appoint someone else to manage your affairs on your behalf in the future, should you become mentally or physically unable to do so.

Without a valid LPA in place your assets may be frozen even if you have joint accounts. Your loved ones would need to apply to the Court of Protection for a Deputyship Order to appoint a suitable person to manage the incapacitated person’s affairs. which is much more costly and time consuming.

Making an LPA is, in some ways, like taking out an insurance policy. It is a one-off transaction. We hope you would never have to use it, but you have the peace of mind of knowing that it is in place if ever required.

When should I consider making an LPA?

You should not wait for signs of mental or physical deterioration to set up an LPA, as that

will often be too late. Watkins & Gunn advises all clients to consider preparing LPAs, irrespective of their age or health for complete peace of mind in having their affairs in order and protecting their loved ones.

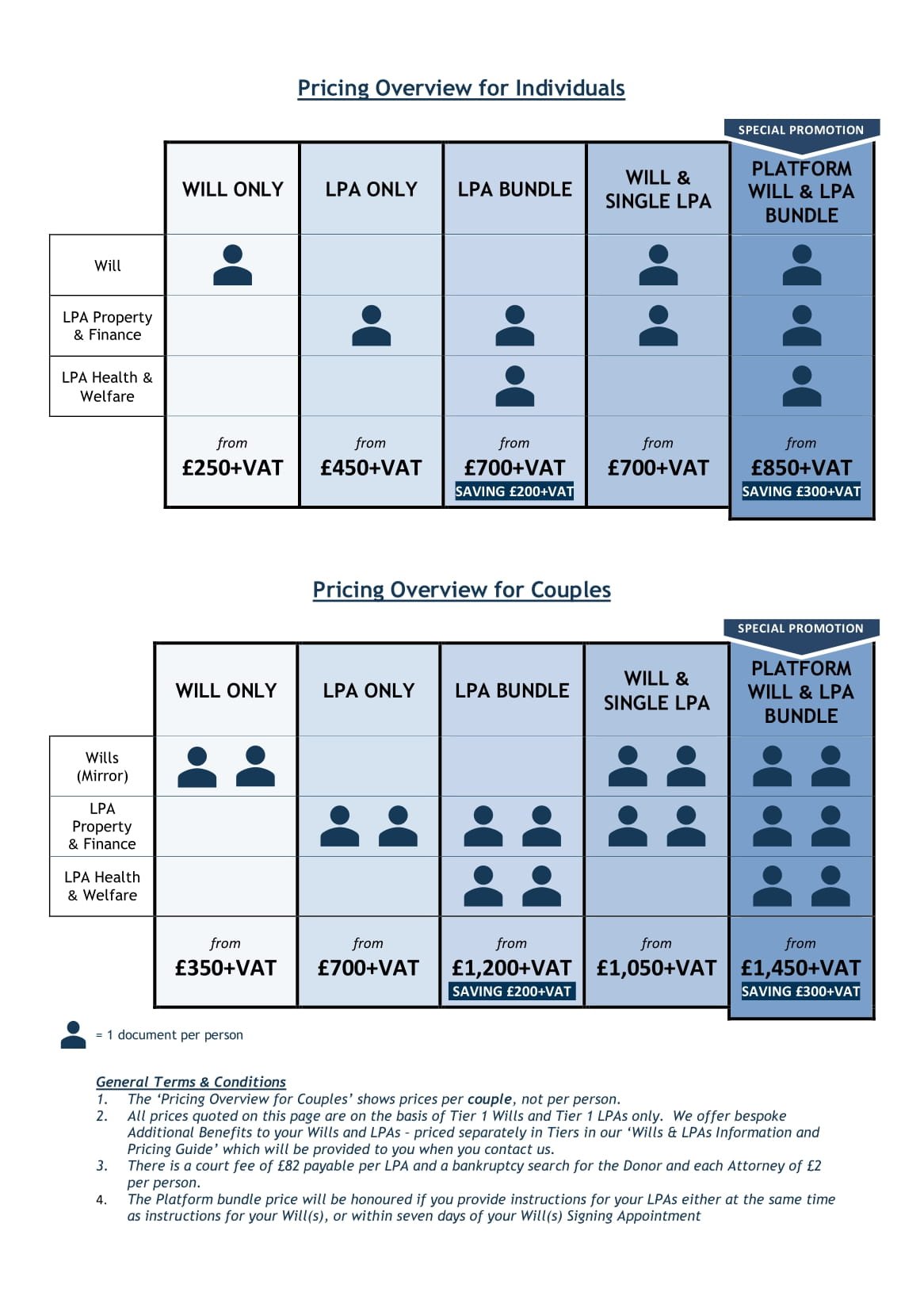

Speak to us today to get a clear and complete LPA creation quote which is backed by our award-winning customer service and expertise.

Your Problem Solved

Our friendly team is understanding, professional and clear, at all times.

We’ll give you jargon-free advice without any hidden costs.

Contact us today to see how we can help you.